- ETRUX launches new Ford E-Transit Trizone

- Renault gives UK debut to Master E-Tech at CV Show

- Isuzu D-Max long-term test – Latest Report

- Isuzu D-Max V-Cross Steel Edition revealed

- IVOTY Report: Stellantis explores the hydrogen proposition

- New Maxus EVs include eDeliver 5 van

- Used LCV values reach six-month high

- ADVERTISEMENT FEATURE: IVECO Daily Mission Awards 2024 Q2 Round-up: Grounds Maintenance & Forestry

- Stellantis Pro One electric vans review

- Mitie adds 5,000th EV to fleet

IVOTY Report: Factory of the future

Date: Monday, October 30, 2023 | Author: George Barrow

Toyota pioneered of the hybrid powertrain. Could hydrogen be its next big initiative?

Toyota expects to sell more than 100,000 hydrogen units by 2030, despite not yet having a single hydrogen model available on the market. That’s according to the president of Toyota’s Hydrogen Factory (Global), Mitsumasa Yamagata, who anticipates that most of these sales will be of commercial vehicles.

According to Yamagata, in order to respond to this “rapid market change”, Toyota established its Hydrogen Factory business and developed its so-called “multi-pathway” approach to future mobility.

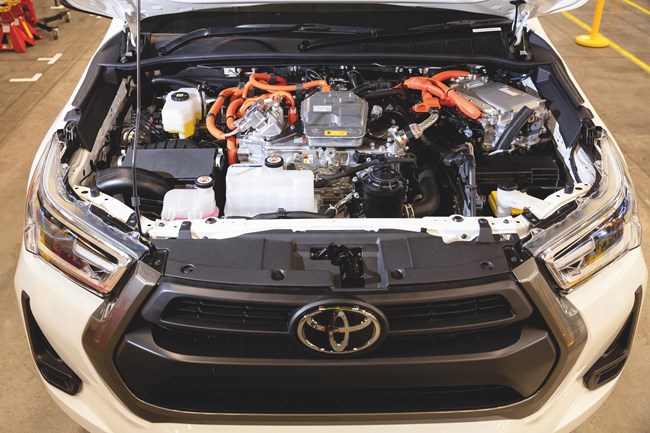

Hiroki Nakajima, Toyota executive vice president and chief technology officer, has previously said that as of March 2023, Toyota has shifted more than half of its R&D staff and approximately half of its R&D expenses to Advanced Development fields, which include BEV and hydrogen. The first fruit of this labour in the light commercial vehicle world was the announcement of a hydrogen prototype version of the Toyota Hilux pick-up truck.

Built in the Burnaston plant in Derbyshire by Toyota Motor Manufacturing UK (TMUK), the project’s aim is to adopt second generation Toyota fuel cell components –first launched in 2021 and used in the latest Toyota Mirai – in a fuel cell electric Hilux pick-up. A study by TMUK began in early 2022 with design and development starting in July, but prototype construction of the vehicle with consortium partners Ricardo, ETL, D2H Advanced Technologies and Thatcham Research was completed in just three weeks in June this year. The hydrogen is stored in three high-pressure fuel tanks, located between the chassis of the truck, giving the prototype Hilux a range of 600km (373 miles) with 10 expected to be built by the end of the year.

The prototypes will then undergo testing to ensure safety and durability ahead of possible full-scale production towards the later half of this decade.

Yamagata explains that Toyota expects unit orders of 100,000 fuel cells per year by 2030 in a sector worth around €32bn (£28bn) per year for LCVs and medium and heavy duty trucks. Because of varying applications and vehicle sizes for hydrogen within the commercial vehicle market, Toyota’s fuel cell is modular in its design.

“As part of our muti-pathway approach, we believe hydrogen will play an increasingly important role next to the other powertrains on our way towards carbon neutrality. When it comes to long distance or heavy loads, like in trucks or 24-hour use in buses and LCVs, it will be most suitable. We are also working on developing scalable stacks where the number of cells can be changed according to the size of vehicles. This will allow usage from trucks to passenger vehicles. We are also working on creating complex shape tanks for various types of vehicle from large to small. It will make it possible to convert existing vehicles to FCEVs and hydrogen engine vehicles,” Yamagata says.

Toyota’s multi-path strategy for achieving carbon-free mobility also sees it develop an array of different powertrains that include hybrid electric, plug-in hybrid electric, battery electric and hydrogen combustion, as well as hydrogen fuel cell electric. Toyota will also develop liquid hydrogen tanks for use in larger vehicles, and intends to launch a third generation fuel cell in 2026 that will increase range by 20% at a greatly reduced cost of around 50%.

Thiebault Paquet, vice-president of Hydrogen Factory (Europe), will oversee Toyota’s hydrogen roll out in Europe and the UK, where Toyota expects to be carbon neutral by 2040, 10 years ahead of its global aim.

“Hydrogen is really a key enabler to reach these carbon neutral goals. It’s not just the case for Toyota, it’s the case for all of Europe. Hydrogen is going to be one of the major building blocks of the repower EU plan, but in order to make hydrogen succeed we need a robust infrastructure to support distribution, the storage and the accessibility of hydrogen,” he explains.

Toyota Hydrogen Factory’s ambitions don’t just lie in automotive, however, as it sees the technology being applicable in all manner of industries, from passenger cars, trucks and buses to marine and power generation.

Its fuel cell has already been used in Energy Observer, a pioneering zero-emission, self-sufficient boat with a 1MWh fuel cell and storage for up to 63kg of hydrogen.

“The Energy Observer pioneered the fuel cell technology in the marine environment. It built and developed the marine range extender, housing the Toyota fuel cell and it is now being used by customers like the Hynova boat and the Fountaine-Pajot company. Again, in partnership we have developed a hydrogen power generator. Apart from being zero-emission, the generator is also silent and odourless,” Paquet says.

Toyota has already put a fuel cell heavy truck into operation to decarbonise its logistics operations in Europe. Working with Dutch manufacturer VDL Groep, the truck will allow Toyota and its logistic partners to test its operation in the real world across Europe on major routes between Antwerp, Lille, Cologne, Amsterdam and Rotterdam. Like the Hillux prototype, it’s another example of how Toyota is pursuing fuel cell development to solve current transport problems.

While Paquet would not comment on the future of its fuel cell LCVs and whether such technology would ultimately be shared with Stellantis – which produces its vans – he did indicate that Toyota sees it an appropriate segment for hydrogen.

“The LCV market is very suitable for fuel cells. Because the way light commercial vehicles are operated is they often go from one location to another and they follow certain routes. In that sense, for the infrastructure it is a much easier combination. Also, in some areas of LCV, 24-hour operation is very important, charging means downtime. So, there’s a number of arguments why some LCV users would be helped with a fuel cell vehicle. That is a market we need to consider,” he says.

It will surely only be a matter of time before we see Toyota publicly installing its fuel cells in vans for testing and only time will tell if fuel cell vans will trump battery electric vehicles as we currently know them.

Combustion versus fuel cell

Much of Toyota’s recently publicised developments have been around hydrogen fuel cells, but hydrogen combustion engines will play a significant role in decarbonising the commercial vehicle segment at a lower price point.

“We see both technologies evolving very fast and both have benefits and also weak points,” explains Mitsumasa Yamagata.

“We have to consider the various KPIs when it comes to defining which technology is more suited for which [vehicle]. One big point to consider is the costs. The cost for the consumer, what does he or she pay for the vehicle itself and what does he or she pay for the fuel. We see that both technologies, the hydrogen combustion and also the fuel cell technology, they have to get lower in price and then we also have to consider the fuel price of the hydrogen itself. Then there is the matter of efficiency, which is more efficient in which use case? We see for example, bigger trucks seem to be more efficient than smaller cars. So we have to consider several points to be able to decide which technology is better suited for which use case so that the customer has the best efficient balance when it comes to costs.”

Hydrogen: The new diesel?

Prior to speaking with Toyota’s Hydrogen Factory boss Mitsumasa Yamagata, someone asked me if I thought hydrogen would replace diesel within the next 10 years. At the time, I dismissed the idea with a terse and flippant response, something along the lines of “not bloody likely”. Thinking about it now, I’m still adamant it won’t have replaced diesel but I can see it occupying a space similar to where electric vehicles are now.

Commercial vehicle uptake of alternative fuels will always differ compared to the retail car market, but the fast-filling times of hydrogen makes more sense to a haulier, business or tradesman than a typical charge-at-home EV car buyer. Despite that, I still don’t think hydrogen will have taken off, if only purely from an infrastructure point of view. To answer the question, 10 years from now I can see hydrogen being in the same place that electric vehicles are now. That may mean vehicle sales of around 15% while EVs replace ICE vehicles as the best sellers with around 40–50% market share. ICE engines will still feature heavily in the remainder as the industry and buyers prepare themselves for the now extended 2035 new petrol and diesel vehicle ban deadline.

The questions that remain, how many of those will be CVs and what type and weight? That is anybody’s guess, but unlike electricity where passenger car uptake has led the trend, I’m adamant it will be commercial vehicles that instigate the hydrogen revolution.

George Barrow is the UK jury member for the International Van of the Year award.

View The WhatVan Digital Edition