Telematics systems have become an increasingly big part of van fleet management in recent years, allowing companies to monitor their vehicles and drivers and implement management practices that should make them safer and more efficient. Until recently, fleets that wanted to benefit from this had no option but to go to a third-party supplier.

Now, however, an increasing number of van manufacturers are bringing to market their own factory-fit, in-house systems, suggesting the opportunity is there to cut out the middle man. But could fleets really be better off with these rather than tools from third-party specialists?

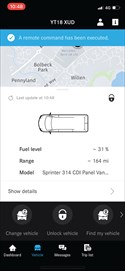

Mercedes’ Pro Connect system

One manufacturer to enter this market is Mercedes-Benz. It launched its Mercedes Pro Connect system with the latest Sprinter in 2018. Free for three years, it offers features including location and mileage tracking, driving-style monitoring and service scheduling, and is being regularly updated, with the latest additions including remote vehicle access and a digital driver’s log.

One manufacturer to enter this market is Mercedes-Benz. It launched its Mercedes Pro Connect system with the latest Sprinter in 2018. Free for three years, it offers features including location and mileage tracking, driving-style monitoring and service scheduling, and is being regularly updated, with the latest additions including remote vehicle access and a digital driver’s log.

According to James Riddington, Mercedes-Benz marketing manager for connected vehicles, an advantage over third-party systems is that where those rely on devices such as a GPS box or a plug-in to the van’s onboard diagnostics (OBD) port, the Mercedes system takes its data directly from the vehicle via 4G, making it more accurate.

He says: “For our driver behaviour system we use a throttle position sensor and brake position sensor. Fuel consumption monitoring is from the fuel sensor in the engine, so it is more accurate.”

Riddington says other advantages of the Mercedes system over third parties include better security, interfacing directly with the vehicle’s alarm system to send alerts to the driver and fleet manager if it’s triggered, allowing remote tracking with GPS if the van is moved, and allowing it to be remotely locked and unlocked.

It also allows direct interfacing with service schedules using data from the vehicle.

However, Riddington does not claim that Pro Connect will be able to replace all the functionality of third-party systems for every fleet.

He says: “[Third parties] have been around for 20-plus years, and some elements they provide are highly bespoke. We can provide a solution where a customer can build a bespoke solution, but what we cannot do is tailor the system to do X, Y and Z.

“Third parties do not cost an insignificant amount of money. We are trying to provide a solution that caters for everyone 90% of the time as opposed to maybe paying a significant amount of money for something that does 100% of your requirements.

“If you have requirements that currently can only be catered for by a third party, you should continue to use them. I don’t think anyone in this building would say people don’t need third parties anymore, but what we’re saying is we’re trying to revolutionise the way vehicle data is given to customers.”

To facilitate this, alongside the full Pro Connect management system option Mercedes also offers an API data feed that can interface with fleets’ own systems to meet more bespoke requirements.

This split approach is also being followed by Ford. The UK’s best-selling LCV manufacturer offers the Ford Telematics platform with fleet management dashboard, and also Ford Data Services, which allows the data from vehicles to integrate with an existing user interface.

In addition, Ford offers the app-based FordPass Pro, said to be aimed at small fleets, which provides the driver with everyday information such as fuel level and tyre-pressure monitoring.

Dave Phatak, director of Ford commercial services for Europe, explains: “We know that our fleet customers are not homogenous and we have to provide solutions for many different use cases. For example, the needs of rental operators may be very different from the needs of van drivers within a small fleet or a company car driver within a large fleet.

“For our small-fleet customers we offer app-based solutions which support the driver of the vehicle with everyday information about the health and security of their vehicle and its readiness to support their business (fuel level, tyre pressures etc.).

“For our larger customers we have developed more sophisticated solutions, which are designed to support the needs of a fleet manager who might be operating tens, hundreds or even thousands of vehicles on a remote basis.”

As with Mercedes’ Riddington, Phatak believes it will come down to customers’ specific needs whether the full Telematics or the Data Services package is right for them.

He says: “We believe that our customers should make that choice based on what is most important to them. By providing the power of choice, we are giving our customers the flexibility to determine what is best for their business.

“The embedded modem that Ford is now fitting at plant across the vehicle range means that this flexibility stays across the vehicle’s life. If a customer wants to switch from Ford Data Services to Ford Telematics or vice-versa, or if a second owner wishes to subscribe to a product, then the embedded Ford modem makes this possible remotely and without any concerns about the cost or time involved with fitting or removing other hardware.”

Phatak says that Ford Telematics has been designed with a primary focus on delivering uptime for fleet customers, and adds: “As the company that engineered the vehicle and leveraging the wider capabilities within the Ford ecosystem, we believe that we can create the best telematics tool that delivers uptime to Ford fleet customers.”

Ford: ‘We have to provide solutions for many different use cases’

Trakm8 says it offers benefits OEM systems can’t

(Continued from page 1) Other van manufacturers now providing their own telematics systems include Renault, which offers the Easy Connect for Fleet product.

This sees a vehicle-fitted telematics unit send out data including mileage, range, location, fuel consumption, tyre pressure, technical alerts and information on when the next service is due. This data can be sent to third-party systems, or to a system developed by Renault’s RCI Bank and Services subsidiary.

Sister brand Renault Trucks has also entered the telematics game with its Vantelligence system. This is available in two modules: Vantelligence Control for vehicle tracking and mapping, and the more integrated Vantelligence Optimum Control, which monitors vehicle and driver performance using 20 driving-style parameters, including idling time, over-revving and harsh braking.

The system can also integrate with existing onboard weight, temperature and camera systems.

Another joint truck and van company offering telematics is Iveco. Its latest Daily launched last year with the MyDaily portal, allowing owners to monitor their vehicle from a desktop or mobile device.

It offers performance, fuel consumption and driving-style analysis, and sends regular reports advising on more fuel-efficient driving, as well as helping to plan servicing.

In addition, Iveco offers a fleet management system in partnership with third-party supplier Verizon Connect, with features including advanced engine diagnostics and near real-time mileage reporting.

While there are plenty of van manufacturers entering the telematics space, third-party providers aren’t going away. Sean Morris, insurance and automotive director for Trakm8, says its products offer a number of benefits over OEM systems: “For example, if you have more than one vehicle in your fleet, Trakm8’s system can give a user a single view of that fleet in a common language, regardless of the brand.

“More importantly, Trakm8’s solutions have been developed over many years in conjunction with the vehicle owners themselves and are therefore tailored to their requirements.

“The OEMs have little, if any, experience of talking to fleet owners/drivers about what they need from telematics to meet the requirements of their individual business.”

In addition, Morris points out that many vans are customised to suit a specific business, and may require separate sensors fitting, such as to monitor temperature of the storage area for food deliveries.

He says: “Trakm8’s solution(s) can have extra sensors connected to report their status, which OEMs currently do not do.”

When asked if Trakm8 has concerns about van manufacturers encroaching on the market, Morris says: “Trakm8’s system can ingest data directly from the OEM-fitted devices so we can still report the data to our customers via a single user interface regardless of the source of the data.

“Whilst OEMs are installing telematics on some models, the data is expensive and limited to the data set the OEM wants to share.

“Trakm8’s Connectedcare has been designed to deliver the data our customers want and need to keep their vehicles on the road. For example, through deep CANbus connectivity, customers can gain remote access to readings directly from the dashboard or instrument cluster.

“These include diagnostic trouble codes and dashboard warning lights from cars, light commercial vehicles and plant equipment via easy-to-use web portals and mobile apps.”

Morris adds that Trakm8 products are also fitted in mainstream OEM dealerships through various schemes.

One area that OEM telematics systems are yet to move into is on-board cameras, which could put third-party firms that supply these systems at a continuing advantage.

Paul Singh, CEO of camera telematics firm SmartWitness, says: “The mountain of compliance legislation and safety rules that manufacturers have to go through with cameras has been the main reason why there hasn’t been a single OEM camera system so far.

“Also, these compliance rules tend to change fairly often or get updated, so even if cameras were pre-fitted they may need to be replaced to meet new safety standards, and that’s going to be too much hassle for a lot of vehicle manufacturers.

“Clearly, we would be concerned if a big manufacturer announced an OEM [system] across all their ranges but we feel it’s unlikely because cameras aren’t a one-solution-fits-all product. It’s a very bespoke offering and every fleet has different needs.”

SmartWitness CP2 camera with in-cab camera

Iveco’s Daily launched last year with the MyDaily portal

(Continued from page 2) For Singh, at this stage manufacturer systems actually provide an opportunity for SmartWitness, since its cameras are compatible with all the manufacturer systems and can therefore cater for fleets who adopt them but want to add cameras.

He adds: “Tracking systems without video won’t provide improvement in safety records, better FNOL (First Notice of Loss) or reduction in exposure to bogus claims, so this has actually been a positive move for SmartWitness.”

When asked if SmartWitness would be involved with OEMs on a white label basis, Singh says: “Watch this space. It’s something we have been in talks with in the past and it would make sense for the manufacturer to come to us so that we can future-proof their camera offering, so it lasts for the lifespan of the van.”

Driver wellbeing

Beverley Wise, director UK & Ireland at Webfleet Solutions, examines the role fleet tech can play in looking after van drivers’ health and wellbeing

Beverley Wise, director UK & Ireland at Webfleet Solutions, examines the role fleet tech can play in looking after van drivers’ health and wellbeing

Van drivers can face a wealth of health and safety risks – and while it can be a case of ‘out of sight, out of mind’ for many operators, legislative obligations have gone a long way to catapulting UK road safety up the fleet agenda in recent years.

Road risk management programmes have become commonplace, underpinned by health and safety policies and tools dedicated to monitoring and improving driver behaviour.

Wider areas of driver wellbeing however, both physical and mental, can often be overlooked as operational performance and profit take centre stage. This failure to pay sufficient heed to all areas of wellbeing can have a significant impact on business costs, from low morale and reduced productivity to higher levels of employee absence and staff turnover.

Physical health considerations include anything that might impact employees’ fitness to drive, from musculoskeletal conditions to eyesight.

Tackling driver stress

Unlike physical health, mental wellbeing isn’t always as easy to identify or address but has become a focus for many HR departments. Fleet managers should also take note – from a mobile workforce perspective, it deserves special attention.

Any occupation that involves driving can be stressful – and stress can be a major cause of mental ill-health, contributing to disorders ranging from anxiety to depression.

Stress-inducing factors prevalent in working environments can include long working hours, tight schedules, deadline pressures, traffic congestion and isolation.

In their efforts to effect meaningful change, companies need to understand precisely where the stress points exist. But once identified, the effective use of fleet technology solutions can play a big role in providing an antidote. Efficient job scheduling, for example, can be conducive to a less stressful working environment, with accurate management information promoting sensible workloads and realistic deadlines. Telematics here enables smart job allocation, helping reduce mileage and time spent on the road.

A spotlight on fatigue

Coupled with these digital planning tools, van drivers should be encouraged to take frequent breaks to help keep them alert.

Journeys should be planned to allow for these breaks to be taken, and fleet managers should take account of those times of day when incidents involving fatigue are most likely to occur. Research has suggested that the most common times for drivers with normal sleep patterns to fall asleep at the wheel are early morning and early afternoon.

Streamlined working

Routing and scheduling solutions, which can be integral to telematics platforms, offer an additional layer of planning information. They not only serve as a fillip to operational processes but can also have a stress-busting role in improving drivers’ working lives.

Improved levels of dynamic planning mean that when delays occur schedules can be more easily adapted, and jobs reallocated, in real time. Field workers no longer need to be contacted to be informed of schedule changes. Instead, they can be automatically notified via in-vehicle devices, and navigation instructions revised accordingly.

In addition, the frustrations at being stuck in traffic and the pressures of leaving customers waiting can also be a major source of stress for van drivers.

Smarter navigation and routing systems that incorporate traffic information enable companies and drivers to plan around delays, leading to marked reductions in journey times.

Elsewhere, the administrative burden on van drivers can be alleviated by connected end-to-end tech that streamline working processes. Apps are now available, for example, that digitise a range of tasks, from mileage capture to vehicle safety checks.

By leveraging such fleet tech, companies can not only work smarter, but also protect their business health, driver wellbeing and their business reputations.

Sponsored by